Fintech

Fintech Software

Development Company

We build custom fintech software solutions for banking, payments, lending, and wealth management, designed for high-performance, and user trust. Our goal is to deliver efficient, secure, and compliant fintech applications that solve real business challenges.

75+

Team Size

10+

Years of Experience

100%

Satisfaction Rate

-

Trusted By 250+ Happy Clients

-

100+ Technologies we work

Our Fintech Software Development Services

We offer a range of fintech software development services tailored for banks, financial institutions, startups, and fintech companies.

Advanced Technologies We Leverage

for Fintech Software & App Development

We use secure and future-ready technologies to develop fintech applications.

Blockchain

- For secure and transparent transactions, smart contracts, crypto wallets, and decentralized finance features.

AI/ML (Artificial Intelligence & Machine Learning)

- To power chatbots,credit scoring, risk analysis, fraud detection, and personalized financial advice.

Internet of Things (IoT)

- For real-time data and connectivity in financial environments like insurance telematics or smart POS systems.

Cloud Services

- Scalable and compliant infrastructure for hosting, managing, and updating fintech solutions.

Must-Have Features in Fintech Software Development

Our Fintech Software Development Process

Our fintech software development services follow a clear, step-by-step process to ensure success.

-

1

Fintech Requirements & Regulatory Discovery

We begin by understanding your business model, financial workflows, and regulatory needs (like KYC, AML, PCI-DSS). This ensures your solution is aligned with compliance and market expectations from day one.

-

2

Wireframing & UX for Financial Interfaces

We create wireframes and user flows designed for trust, clarity, and ease of use, especially important for sensitive tasks like payments, transactions, and investments.

-

3

Custom Fintech Development & Security Implementation

Our developers build the application using secure coding practices and fintech-specific architectures. Encryption, secure payment integrations, and fraud prevention mechanisms are embedded from the start.

-

4

API Integrations & Fintech Ecosystem Connectivity

We integrate with banking APIs, credit bureaus, payment gateways, investment platforms, and third-party financial services to enable smooth operations across systems.

-

5

Testing, Audits & Regulatory Validation

We conduct multi-layered testing - functional, performance, and security, as well as compliance audits to meet regulatory standards before launch.

-

6

Deployment & Long-term Support

Once live, we continue to monitor, update, and optimize your fintech product for performance, regulatory changes, and new user needs.

Why Softices is a Reliable Fintech Development Company

-

Deep Understanding of the Fintech Industry

We bring industry-specific knowledge, staying up to date with the latest in digital banking, financial regulations, and user expectations.

-

Expertise in Custom Fintech Software Development

From banking apps to financial management apps, we have a proven track record of delivering secure, scalable, and compliant fintech solutions.

-

Security-first Approach to Coding

We follow secure coding practices with a strong emphasis on data privacy, encryption, and risk mitigation across every feature.

-

Full-Cycle Development Services

From idea validation to post-launch maintenance, we offer complete fintech app development services under one roof.

Build

Secure & Scalable Fintech Solutions

Hire fintech developers from Softices and bring your idea to life. We’re your trusted fintech software development company and beyond.

Discuss Your Project Requirements

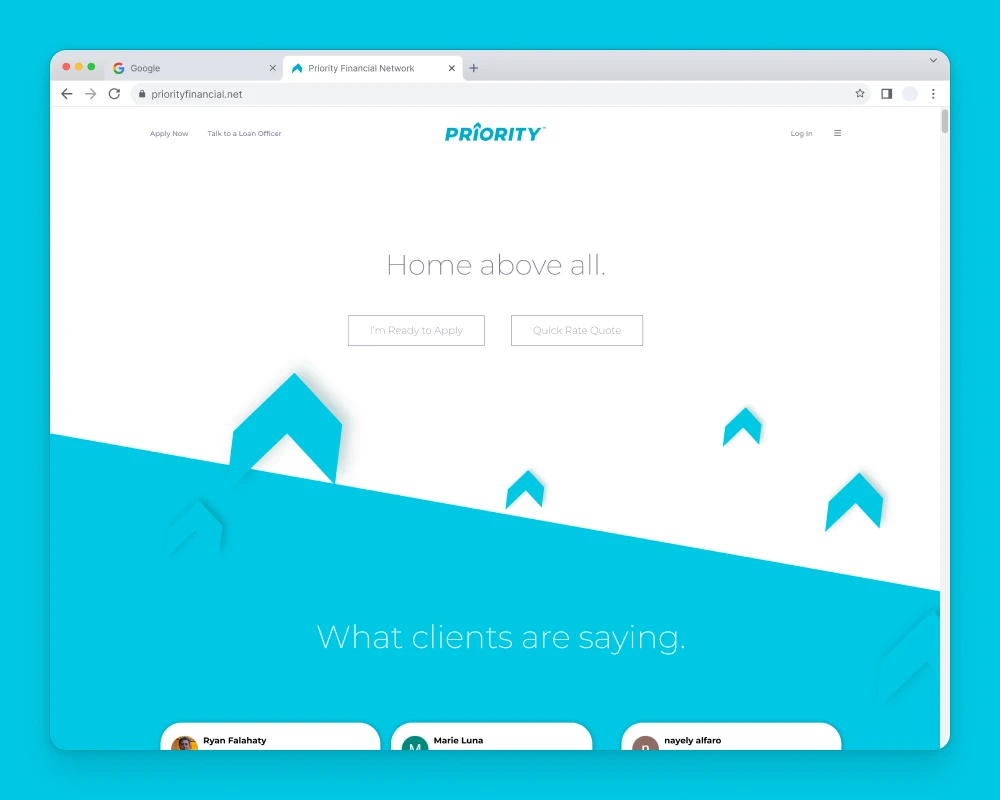

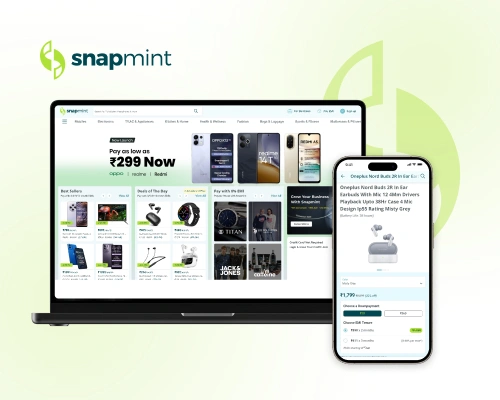

Successfully Developed

Fintech Solutions

Explore how we helped fintech businesses launch successful software applications.

Have a project to discuss?

Start a ProjectHear it From Our Clients

Our Trusted Clients

Insights in Fintech Software Development

Get insights on fintech trends, technologies, and tips. Read our latest on fintech application development services and innovations.